Content

Don’t statement duplicate withholding otherwise withholding to your nonpayroll money, for example retirement benefits, annuities, and gambling earnings, for the Forms 941, Mode 943, or Setting 944. Withholding to your nonpayroll repayments is actually stated on the Versions 1099 otherwise W-2G and ought to be claimed to your Function 945. Simply taxes and you can withholding claimed for the Mode W-dos is going to be claimed to your Models 941, Function 943, or Mode 944. Independent accounting whenever places aren’t produced otherwise withheld taxation aren’t paid.

Region 4: Influence Your FUTA Taxation and you will Amount owed otherwise Overpayment

Taxpayers who don’t provides a checking account can visit the new FDIC web site to own details about banks that allow her or him unlock a free account online and choosing the best membership. Experts are able to use the fresh Experts Professionals Banking Program to possess use of financial services from the playing financial institutions. Taxpayers just who meet the requirements however, don’t claim people portion of the borrowing on the 2021 taxation return would be to discover these payments by the later January 2025. The brand new commission would be delivered to the lending company membership listed on the fresh taxpayer’s 2023 income tax return or to the fresh address from checklist. This type of December costs to your 2021 Healing Rebate Credit are just attending taxpayers in which Internal revenue service investigation demonstrates a great taxpayer qualifies to have the credit. Licensed taxpayers are the ones whom submitted a good 2021 taxation get back, but in which the research career to the Data recovery Promotion Borrowing is actually leftover empty or is actually completed because the 0 when the taxpayer got entitled to the financing.

Financing You to Quicksilver Bucks Advantages Mastercard

You must keep back government taxation in line with the energetic time specified in the amendment notice. You should and keep back based on the observe otherwise modification find (told me 2nd) should your staff resumes the employment connection with your inside several weeks following the termination of the employment dating. 15‐T will bring an optional computational bridge to alleviate 2019 and prior to Variations W‐4 because if these were 2020 or later Variations W‐4 to have purposes of calculating government tax withholding. See how to Remove 2019 and you can Before Versions W‐cuatro since if These people were 2020 otherwise After Versions W‐cuatro under Inclusion in the Club. For those who withhold lower than the desired quantity of public shelter and you may Medicare taxes in the employee within the a season but report and you will afford the right amount, you can even recover the new taxes regarding the employee. You might want not to keep back income tax to the worth of an employee’s personal use of a car your render.

What’s the high-using large-give savings account today?

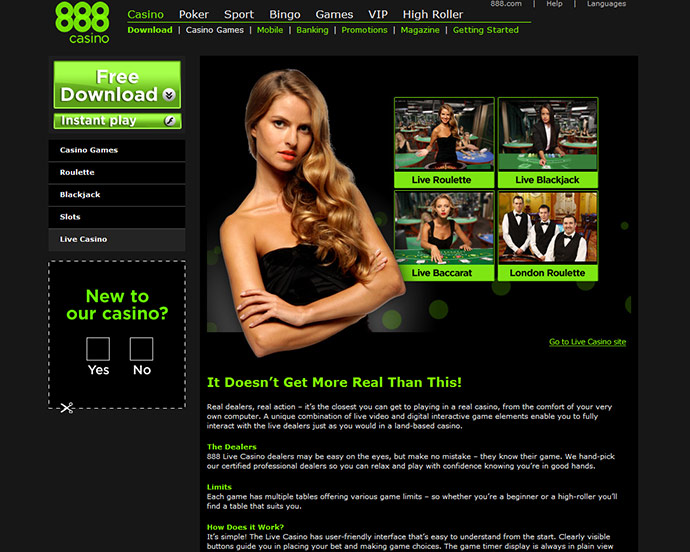

Our publishers are purchased https://happy-gambler.com/eye-of-ra/ providing you with unbiased reviews and you can guidance. All of the membership and you can incentive details try accurate as of Oct step one, 2025. To own organizations that offer place-founded incentives, i used the New york Zip code 10001. We have analyzed among the better no-deposit bonuses to the the market industry over, but there are lots of other available choices you can try whenever searching for various other sweepstakes casino or no put bonus casino to join.

Once you’ve accomplished the requirements, your own extra amount will be deposited inside two months. Once you’ve done certain requirements, your added bonus would be repaid inside 15 days. When you’ve completed the requirements, your own extra was placed within this 15 weeks. The good thing is the fact that conditions is not too difficult and will likely be met instead establishing an immediate put. Once you complete your preferences, the incentive might possibly be placed within 180 months.

Lowest deposit to start

That it change introduced the web costs-out of rates so you can 0.22 fee issues greater than the brand new pre-pandemic average. Interest rate slices drove focus costs and you may interest earnings off to own the brand new one-fourth. But not, desire costs decrease faster than focus income – which triggered the fresh quarterly rise in net gain. So it vibrant led to a great 0.2 percentage part boost in the new ROA proportion, bringing it to a single.11percent. Financial net gain tumbled from the 8.6percent on the 3rd one-fourth, as well as the newest analysis means that one of those losses was retrieved regarding the last quarter of the season.

Deadline to possess Returning the security Deposit

The industry’s express from expanded-name property is still moderately above the pre-pandemic average of thirty-five.0 per cent. Area lender quarterly net gain increased step 1.one percent on the earlier quarter in order to 6.4 billion, inspired by high net attention money and noninterest income one to offset highest noninterest and provision bills. Good morning and introducing all of our launch of 2nd quarter 2024 overall performance outcomes for FDIC-covered associations. Listed below are some our book about how exactly Forbes Advisor analysis banking institutions to help you find out about our rating and you may opinion methodology and editorial techniques. Along side 2nd six so you can 1 year, savings efficiency will in all probability float lower as the Given continues to relieve. Realize our rigid article advice as well as the financial strategy to know more info on the new analysis below.